What Are the Different Types of Accounting Systems? Options Explained

Contents:

It is very important for a company to be aware of what is going on when it comes to money. Under the accrual basis method of accounting, transactions are accounted for when the transaction occurs or is earned, regardless of when the cash is paid or received. Income is recorded when the sale occurs and expenses are recorded when the goods or services are received.

Public companies include businesses that are filed with the Securities and Exchange Commission . Companies not listed with the SEC may also choose to use GAAP rules if they want to seek financing or their accounts are scrutinized by a third party (e.g., auditing). Again, single-entry accounting and cash-basis accounting go hand in hand. Because single-entry accounting is the simplest accounting entry method, cash-basis accounting is also the simplest accounting method. As the easiest method, many small businesses tend to use it for bookkeeping.

Intermediate Accounting (Kieso)

The accounting equation method helps to identify the cash liquidity position of an organization. Balance sheets and income statements are invaluable tools to gauge… It directly reflects the value of cash inflows and outflows, which helps understand the current profitability in monetary terms. In this case, Fabrix Inc. would record revenue of $10,000 and commission expense of $3000 (30% of $10,000) together in the sale period.

Identification of priority pathogens for aetiological diagnosis in adults … – BMC Infectious Diseases

Identification of priority pathogens for aetiological diagnosis in adults ….

Posted: Fri, 14 Apr 2023 14:47:52 GMT [source]

A Schedule C is a form used to report the income or loss from a business, as a sole proprietor. When a sole proprietor files their first income tax return they choose the accounting method that they will be using for their business. You can find this form on the IRS Website here, along with instructions on how to fill it. By sharing the common accounting methods available, along with answering the most common questions that you may have as a business owner. In this case, there is current justification and support for either method.

Understanding Accounting Methods

Because the https://1investing.in/ is recorded when cash exchanges hands, the business owner has a better idea of the company’s cash flow at any given time. Accrual accounting records the dollar amounts when a transaction occurs, not when the cash is actually exchanged. An accrual accounting method is required by law when a business exceeds 5 million in sales. It is believed that this method of accounting gives a more accurate picture of a company’s finances. As the name suggests, modified cash-basis accounting is a hybrid accounting method. Modified cash-basis accounting blends cash basis and accrual accounting, making it a happy medium for business owners.

- This also means that any sales or expenses aren’t reflected in the financial statements until the amount is realized, and investments in inventory are shown as expenses until they can be sold for cash.

- If you’re stuck choosing between accrual or cash accounting, we can help!

- If the two conflict, tax accounting principles control for tax purposes.

- Numbers were almost an afterthought because, obviously with lockdowns and with stimulus everyone was purchasing online, so more and more ecommerce businesses were spinning up.

- It also offers a more accurate picture of a company’s assets and liabilities on its balance sheet.

Companies usually use the cash method of accounting because they deal mostly with cash transactions. They need safeguards over receipts and disbursements of cash so it’s not lost or stolen. Businesses with less than $25 million in gross receipts do have a choice. For details on how to apply the gross receipt test, the IRS guidelines on acceptable accounting methods and how to change your accounting method, refer to IRS Publication 538. Cash and accrual accounting are like sibling rivals in the accounting realm—one clashes with the other, but you can definitely see the resemblance. Even if you don’t handle your own financial reporting, it’s vital to know how each one works so you can choose the best bookkeeping practices for your business.

Cash-Basis vs. Accrual-Basis Accounting: What’s the Difference?

Many small businesses opt to use the cash basis of accounting because it is simple to maintain. It’s easy to determine when a transaction has occurred and there is no need to track receivables or payables. These are the two main types of accounting methods, although sometimes companies are allowed to use a hybrid of the two, if certain conditions are met. While accrual accounting is indispensable in modern businesses, it does have its shortcomings, such as a steep learning curve and greater complexity that can be a burden for small business owners. If you use accrual accounting, accounting software solutions and professional accountants are a necessity. Now that we’ve covered the different types of accounting and the three accounting methods, let’s answer the big question.

With NetSuite, you go live in a predictable timeframe — smart, stepped implementations begin with sales and span the entire customer lifecycle, so there’s continuity from sales to services to support. Accounts payable, which can create difficulties when your company does not receive immediate payment or has outstanding bills. For a discussion of the rules governing how to adopt or change an accounting method, see 572 T.M., Accounting Methods — Adoption and Changes. Let’s look at an example of how cash and accrual accounting affect the bottom line differently.

Thankfully, the IRS sets rules on who can and cannot use each method. Particular Accounting PeriodAccounting Period refers to the period in which all financial transactions are recorded and financial statements are prepared. Cash-basis accounting lets businesses use a mix of accounts such as cash, liabilities, assets and accounts payable. While this method gives an accurate overview of a business’ perceived income, it does not allow you to track loans, liabilities and inventory.

What Is the Difference Between Accounting Profit & Taxable Income?

The importance of a Schedule C, which is a form a sole proprietor fills out when filing taxes. When a Sole Proprietor files their first income tax they choose the Accounting Method they will be using in their business. Let’s face it, sooner or later all companies find themselves in a situation where a client owes them for services and/or products and the client simply can’t pay. By the end of this article, you will know how to use these accounting methods, we will share a few examples at each, the advantages and disadvantages, and more.

Whichever type of accounting method a business decides to use, it must be consistent every year. Using the Accrual Method Accounting the taxes are paid for the bill which is sent out, even if payment hasn’t been made. The accrual transaction is recorded on June 20th, and not August 12th, even if it was paid for in August. The cash transaction is recorded on March 5th and not on January 28th since Client B paid the bill in March. Using the Cash Method Accounting the transaction becomes recorded when the client pays that bill. Using Cash Method Accounting that transaction becomes recorded when the company pays that bill.

Every business must know its financial health in order to stay in operation. Accrual accounting works by recording accruals on the balance sheet that act like placeholders for cash events. For example, accounts receivable is an asset account that reflects revenue a company has earned but hasn’t yet been paid for. Similarly, accounts payable is a liability account that reflects amounts the business owes but hasn’t yet paid. Additionally, it conforms to nationally accepted accounting standards. This means that if your business were to grow, your method of accounting would not need to change.

In the previous example, you would book the revenue for the carpet-cleaning job as soon as you earned the money — when you actually cleaned the carpets. The fact that the customer hasn’t paid yet doesn’t matter for revenue purposes. Also in accrual accounting, expenses are matched to the revenue they produce. Say the carpet-cleaning job required a special disposable attachment for your equipment.

Example of accrual accounting

This is considered the most theoretically correct accounting method, but also requires a greater knowledge of accounting, and so is less likely to be used by smaller organizations. If a business entity does not have to provide financial reports, then it can just keep its books according to tax rules. That’s because the accrual accounting tells you what’s happening at the time it happens. With the accrual accounting method, a company can determine how much money it actually has. Cash accounting is more of an after-the-fact accounting methodology. With cash accounting, you have to wait until cash is actually received.

- It is required by the IRS once the company reaches a threshold of $25 million in annual revenue.

- You had one client during December 2020 and provided consulting services to that client.

- The cash method helps to identify the cash liquidity position of an organization.

Ecords revenue when cash is received, and expenses when they are paid in cash. Whichever accounting method you choose, it will be the same method utilized by your company every year. If you desire to change your accounting method then you ought to apply for approval from the IRS. The equity accounts include owner’s contributions, distributions, and retained earnings. It contains the net effect of postings to all income and expense accounts.

The Direct and Indirect Accounting Methods in a business measure cash flow. It is measured for a specific time and is usually used to generate a Cash Flow Statement. If you desire to learn more about this accounting method and its uses, be sure to check out the article by Investopedia on Accrual Accounting Method. The taxes are paid for the bill sent on April 4th, despite the Client paying the bill on July 16th. Using the Accrual Method transaction becomes recorded when the bill is received. The cash transaction of $800 is recorded on November 3rd, and not September 18th, since the Utility was paid in November.

Its main objective is to provide an accurate overview of an organization’s expenses and profits. Cash accounting is a bookkeeping method where revenues and expenses are recorded when actually received or paid, and not when they were incurred. Cash accounting is an accounting method that is relatively simple and is commonly used by small businesses. In cash accounting, transactions are only recorded when cash is spent or received. Accounting allows a business to monitor every aspect of its finances, from revenues to costs to taxes and more.

Cash basis is a major accounting method by which revenues and expenses are only acknowledged when the payment occurs. Cash basis accounting is less accurate than accrual accounting in the short term. The cash method of accounting is the most commonly used method among individuals and small businesses.

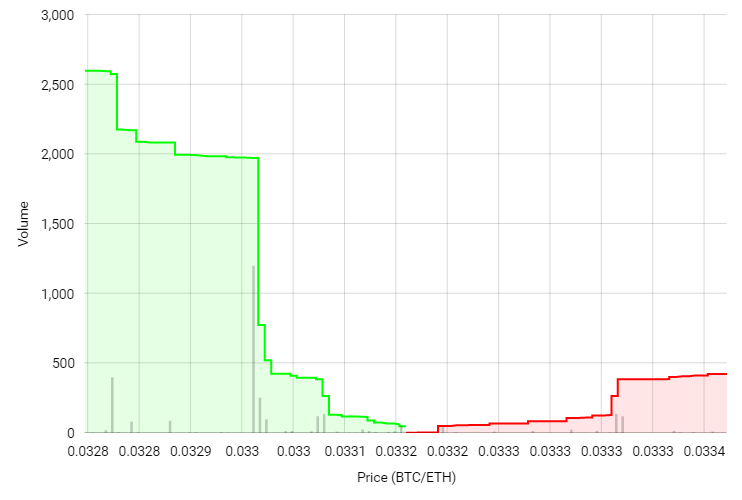

Moving beyond the blockchain trilemma: L1 vs. L2 – Cointelegraph

Moving beyond the blockchain trilemma: L1 vs. L2.

Posted: Fri, 14 Apr 2023 16:00:00 GMT [source]

Getting investors is a great business move, but when investors are in the picture the proper accounting methodology must also be brought in. If you are a small business and have slow-paying customers then Cash Accounting may be best for you. Especially when considering the tax policies, since you only pay when you receive the cash. If you are a bigger company, or intent to grow, then an Accrual Accounting Method would be ideal for future-proofing your company structure.

Plaats een Reactie

Meepraten?Draag gerust bij!