Orion Gold NL Stock Forecast: up to 0 0288 AUD! ORN Stock Price Prediction, Long-Term & Short-Term Share Revenue Prognosis with Smart Technical Analysis

Contents:

1 Wall Street research analysts have issued 12-month price objectives for Orion Group’s stock. On average, they expect the company’s stock price to reach $6.00 in the next twelve months. This suggests a possible upside of 152.1% from the stock’s current price.

According to the paper, this finding has the potential to shift the methods used for market prediction and investment decision-making. AIStockFinder is a company specialized in predictive algorithms. Analyst Ranking shows you which stocks Wall Street analysts like the most. Since analysts build valuation models, this is most useful for medium to long-term investors who are interested in a valuation-based approach. The Short-Term Technical Ranking evaluates a stock’s trading over the past month. This is most useful for short- to medium-term stock and option traders.

Overall, Client Computing sales dropped 38%, AI/data center saw a 39% dive, and Network & Edge had sales that declined 30% YoY. The stock may be up on the fact that it was better than expected, but make no mistake – it was a truly rotten quarter for Intel. Shares are only rising because the apocalypse did not arrive and so shorts are closing their positions.

These returns cover a period from January 1, 1988 through April 3, 2023. Zacks Rank stock-rating system returns are computed monthly based on the beginning of the month and end of the month Zacks Rank stock prices plus any dividends received during that particular month. A simple, equally-weighted average return of all Zacks Rank stocks is calculated to determine the monthly return.

5 Top Stocks From the Prospering Heavy Construction Industry – Nasdaq

5 Top Stocks From the Prospering Heavy Construction Industry.

Posted: Wed, 24 Feb 2021 08:00:00 GMT [source]

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply. Upgrade to MarketBeat All Access to add more stocks to your watchlist. Sign-up to receive the latest news and ratings for Orion Group and its competitors with MarketBeat’s FREE daily newsletter. 53.19% of the stock of Orion Group is held by institutions. High institutional ownership can be a signal of strong market trust in this company.

Upgrade to Premium to unlock Fundamental Ranking

View analysts price targets for ORN or view top-rated stocks among Wall Street analysts. Stock Price Prediction is one of the most exciting applications of Machine Learning. By leveraging data from the past, it is possible to use forecasting models to make accurate predictions about future stock prices. This can be incredibly beneficial for investors and traders, as it gives them the ability to make more informed decisions about when to buy and sell. Investing in the stock market can be a risky endeavor, but leveraging Machine Learning can make it a bit less daunting and more profitable.

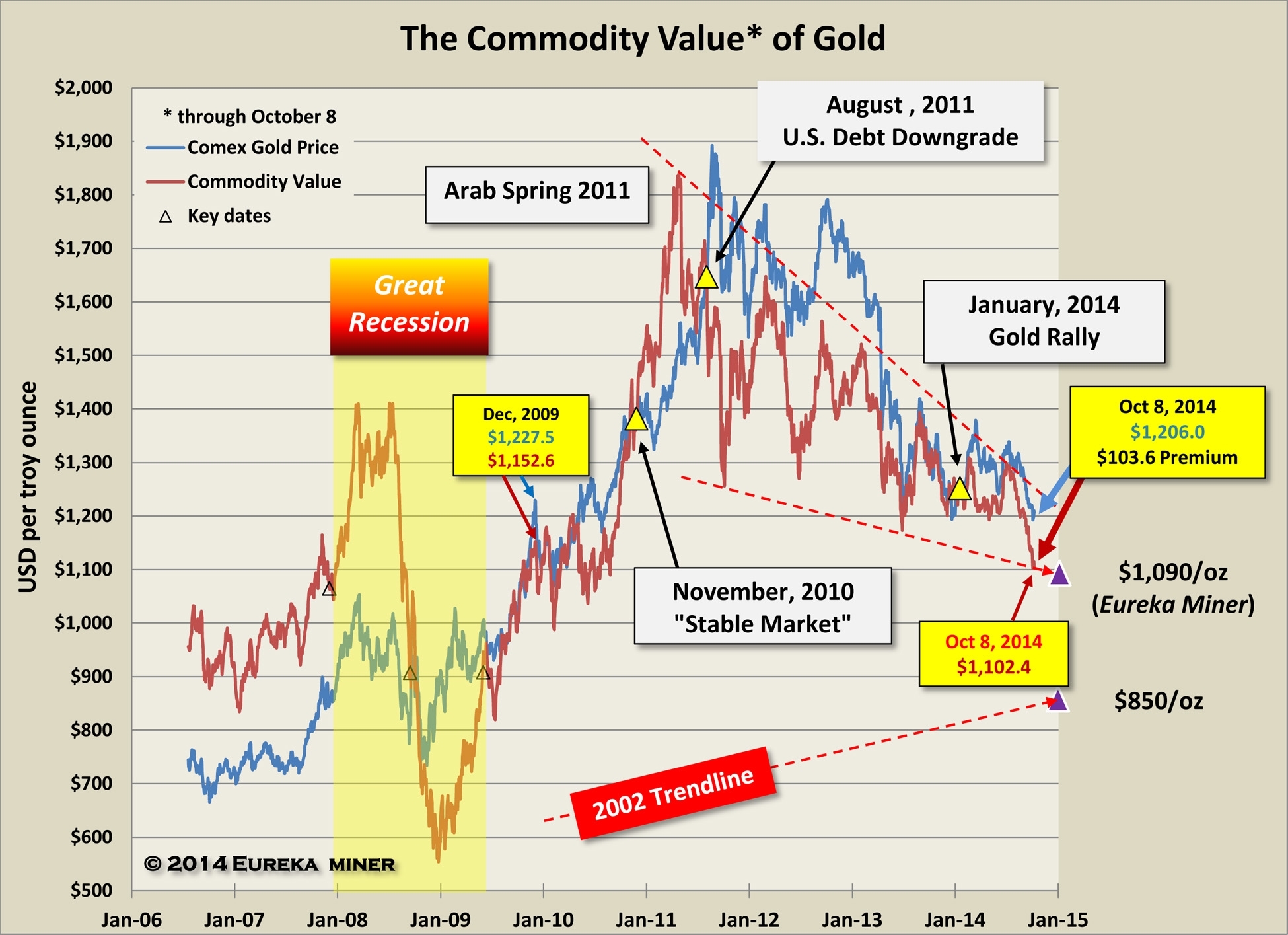

Gold price is hovering around $1,990.00 in the early Asian session. The precious metal is struggling to find any direction as investors are awaiting the announcement of the interest rate decision by the Federal Reserve . The author has not received compensation for writing this article, other than from FXStreet.

Its marine transportation facility projects comprise pub… 1 Wall Street analysts have issued “buy,” “hold,” and “sell” ratings for Orion Group in the last twelve months. The consensus among Wall Street analysts is that investors should “buy” ORN shares. At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors. This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating system. Since 1988 it has more than doubled the S&P 500 with an average gain of +24.27% per year.

Orion Gold NL Stock Chart and Share Price Forecast,

ORN stock price prediction means predicting the future closing prices of ORN stock based on its past data. Our forecasting algorithm uses various machine learning and deep learning techniques to forecast the future behavior of ORN stock in a certain time period. The Wall Street analyst predicted that Orion Group Holdings’s share price could reach $3.00 by Mar 20, 2024. The average Orion Group Holdings stock price prediction forecasts a potential upside of 26.05% from the current ORN share price of $2.38.

Gold Digger: Bring on the recession already, gold bulls plead – Stockhead

Gold Digger: Bring on the recession already, gold bulls plead.

Posted: Fri, 17 Feb 2023 08:00:00 GMT [source]

ORN stock returns are also predicted based on historical data. Get MarketBeat All Access Free for 30 DaysJoin thousands of other investors who make better investing decisions with our premium tools. Access advanced stock screeners, portfolio monitoring tools, proprietary research reports, and more. According to analysts’ consensus price target of $6.00, Orion Group has a forecasted upside of 152.1% from its current price of $2.38. The company’s average rating score is 3.00, and is based on 1 buy rating, no hold ratings, and no sell ratings.

Analyst Ratings

This break above the pivot certainly places INTC stock on a bullish footing. Moreover, both the downtrending 9-day/21-day moving average dichotomy and the bearish Moving Average Convergence Divergence indicator will be upended with this price action. Ultimately, the market continues to be very noisy, and therefore you need to be cautious with your position sizing more than anything else.

Does Great Lakes Dredge & Dock (NASDAQ:GLDD) Have A Healthy Balance Sheet? – Simply Wall St

Does Great Lakes Dredge & Dock (NASDAQ:GLDD) Have A Healthy Balance Sheet?.

Posted: Fri, 23 Sep 2022 07:00:00 GMT [source]

Is always harder so you might want to avoid these stocks if you are not a veteran. Always read up on optimal investment strategies if you are new to investing. If you are good with personal finance and are looking to invest, you will find the Orion Gold NL on AU stock exchange.

ORN Stock Analysis Overview

The monthly returns are then compounded to arrive at the annual return. Only Zacks Rank stocks included in Zacks hypothetical portfolios at the beginning of each month are included in the return calculations. Zacks Ranks stocks can, and often do, change throughout the month. Certain Zacks Rank stocks for which no month-end price was available, pricing information was not collected, or for certain other reasons have been excluded from these return calculations. As per the forecast and algorithmic analysis, ORN stock price can be as low as $2.08 which is -13.02% lower than the current price in the next 2 weeks.

The scores are based on the https://1investing.in/ styles of Value, Growth, and Momentum. There’s also a VGM Score (‘V’ for Value, ‘G’ for Growth and ‘M’ for Momentum), which combines the weighted average of the individual style scores into one score. One share of ORN stock can currently be purchased for approximately $2.38. The P/E ratio of Orion Group is -5.95, which means that its earnings are negative and its P/E ratio cannot be compared to companies with positive earnings. Earnings for Orion Group are expected to grow in the coming year, from ($0.03) to $0.30 per share. Short interest in Orion Group has recently increased by 0.67%, indicating that investor sentiment is decreasing.

The technique has proven to be very useful for finding positive surprises. As an how do currency exchange rates workor, you want to buy stocks with the highest probability of success. That means you want to buy stocks with a Zacks Rank #1 or #2, Strong Buy or Buy, which also has a Score of an A or a B in your personal trading style. You are being directed to ZacksTrade, a division of LBMZ Securities and licensed broker-dealer. The web link between the two companies is not a solicitation or offer to invest in a particular security or type of security. ZacksTrade does not endorse or adopt any particular investment strategy, any analyst opinion/rating/report or any approach to evaluating indiv idual securities.

It allows the user to better focus on the stocks that are the best fit for his or her personal trading style. 17 employees have rated Orion Group Chief Executive Officer Mark R. Stauffer on Glassdoor.com. Mark R. Stauffer has an approval rating of 58% among the company’s employees. This puts Mark R. Stauffer in the bottom 25% of approval ratings compared to other CEOs of publicly-traded companies. Orion Group has a short interest ratio (“days to cover”) of 1.2, which is generally considered an acceptable ratio of short interest to trading volume.

This prediction may vary from other time period filters for ORN stock. The 1 analyst with a stock price forecast for ORN stock has an average 12-month price target of $3.00, which predicts an increase of 26.05%. Short-term and long-term ORN stock price predictions may be different due to the different analyzed time series.

Key Stock Data P/E Ratio The Price to Earnings (P/E) ratio, a key valuation measure, is calculated by dividing the stock’s most recent closing … Stocks Telegraph provides information and tools designed to assist investors and Wall Street players. A major goal is to offer financiers comprehensive information that will help them gain insight into investing.

About MarketBeat

Information is provided ‘as-is’ and solely for informational purposes and is not advice. WallStreetZen does not bear any responsibility for any losses or damage that may occur as a result of reliance on this data. If you’re new to stock investing, here’s how to buy Orion Group Holdings stock. Based on 1 analyst offering ratings for Orion Group Holdings Inc. By creating a free account, you agree to our terms of service.

- Only Zacks Rank stocks included in Zacks hypothetical portfolios at the beginning of each month are included in the return calculations.

- Intel’s reinvigorated foundry business saw revenues tumble by a quarter YoY to $118 million.

- The R1 on the daily chart is currently at $35.39, while the pivot is placed at $30.18.

- The Long-Term Technical Ranking is a good gauge of how a stock has traded over the past several months.

Based on 2 analysts giving stock ratings to ORN in the past 3 months. Intel reported an adjusted loss of $-0.04 per share in the first quarter, which was better than Wall Street’s prediction of a $-0.15 loss. Intel saw revenue tank a miserable 36% YoY to $11.7 billion, but even this figure was nearly $600 million ahead of Wall Street’s somber estimate.

Price target

This is useful for medium to long-term stock and option traders. The Fundamental Ranking considers the health of the underlying company. Our system considers the available information about the company and then compares it to all the other stocks we have data on to get a percentile-ranked value.

It’ll be interesting to see how this plays on next week, because Wednesday features the Federal Reserve interest rate decision, which can have a massive influence on where we go next. Nonetheless, the market is somewhat shooting itself in the foot by rising asset prices, because that’s exactly what will keep the Fed tight for longer. This is a huge game of “chicken” that is being played between the Federal Reserve and traders, and it’s only a matter of time before one of them has to blink. “ORN” stock predictions are updated every 5 minutes with latest exchange prices by smart technical market analysis. According to our research, ORN stock is a bad long-term investment. ORN share price has been in a bear cycle for the past year.

According to Tudal, the Orion Minerals Limited stock price forecast for 2024 Apr. According to Tudal, the Orion Minerals Limited stock price forecast for 2023 May. Our forecasts and predictions are made by Machine Learning and Artificial Intelligence, and shouldn’t be used for financial decisions. Our forecasts aren’t meant for this purpose, but are a good starting point to understand what might happen with your investments in the future. We’re not a financial advisor, so you should always do your own research and get professional advice before acting upon any of the information we provide.

This is our shortest-term evaluation and is best used by people with a very short horizon. Valuation Ranking is most-useful for value-focused investors who plan to hold a stock for the long term. The Long-Term Technical Ranking is a good gauge of how a stock has traded over the past several months.

Plaats een Reactie

Meepraten?Draag gerust bij!